PDF editing your way

Complete or edit your w2c form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export w2c fillable form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your w 2c fillable form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your w2c by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form W-2C

About Form W-2C

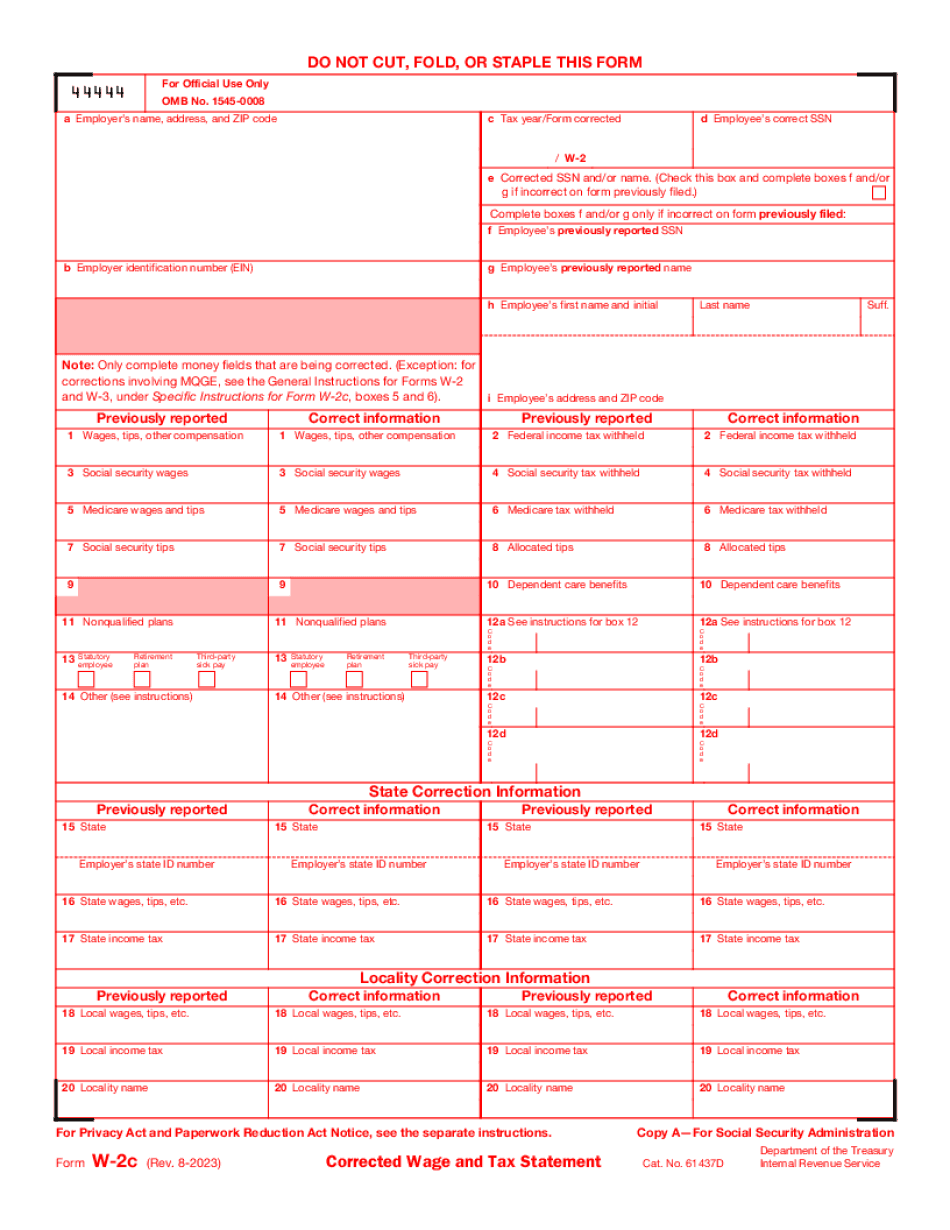

Form W-2C is a correction form used to correct errors on previously filed Form W-2. Employers use it to correct errors such as incorrect Social Security Number, incorrect wages or taxes, or other erroneous information on an employees W-2 form. It must be filed with the Social Security Administration (SSA) and the employee. Employees who have received their original W-2 form with errors need Form W-2C to correct those errors. Employers who have made errors on their employees' W-2 forms also need to file Form W-2C to correct those errors. In addition, the SSA requires employers to file Form W-2C when they need to correct an original W-2 they've previously filed with the SSA.

What Is W2c Form?

All the individuals and organizations have to report certain financial information at the end of each fiscal year. For this purpose they have to prepare and submit different papers. In some cases there can be mistakes or errors in details provided on the documents that must be corrected. To eliminate the mistakes you need to complete and file certain forms.

The IRS Form W-2c is used to correct errors on forms W-2, W-2AS, W-2CM, W-2GU, W-2VI, or W-2c filed with the SSA. Also use this template to provide corrected W-2, W-2AS, W-2CM, W-2GU, W-2VI, or W-2c to employees.

In this article you will find the short instruction for preparing a fillable sample online and a list of details you need to specify.

If you prthe employee one of the above-mentioned forms with some errors, you have to prepare this sample to specify and correct them. Use this paper in case the following items are provided incorrectly:

- employee`s name;

- SSN;

- tax year;

- EIN;

- money amounts.

To correct your documents much more quickly without losing a minute you can fill out an editable blank in PDF online. If required, you can customize a file according to your tax needs using various editing tools. Here find the information that should be furnished on a printable W-2C 2017:

- employer`s name address and ZIP code;

- employer`s federal EIN;

- employees`s name and SSN;

- previously reported details;

- corrected information.

A completed file in PDF can be downloaded to your computer or a smartphone or printed out just in a few clicks.

Online options assist you to organize your doc administration and enhance the productivity of one's workflow. Stick to the quick handbook so that you can complete Form W-2C, stay clear of faults and furnish it inside a timely method:

How to accomplish a Form W-2C over the internet:

- On the web site together with the sort, click Start out Now and pass towards the editor.

- Use the clues to fill out the applicable fields.

- Include your individual details and make contact with knowledge.

- Make guaranteed that you choose to enter accurate information and quantities in proper fields.

- Carefully look at the articles in the type in the process as grammar and spelling.

- Refer that will help portion for people with any problems or tackle our Service workforce.

- Put an digital signature on your own Form W-2C using the assist of Sign Software.

- Once the form is done, press Executed.

- Distribute the all set sort by using email or fax, print it out or help you save in your equipment.

PDF editor makes it possible for you to definitely make adjustments with your Form W-2C from any World Wide Web connected system, customise it in line with your preferences, indication it electronically and distribute in various ways.